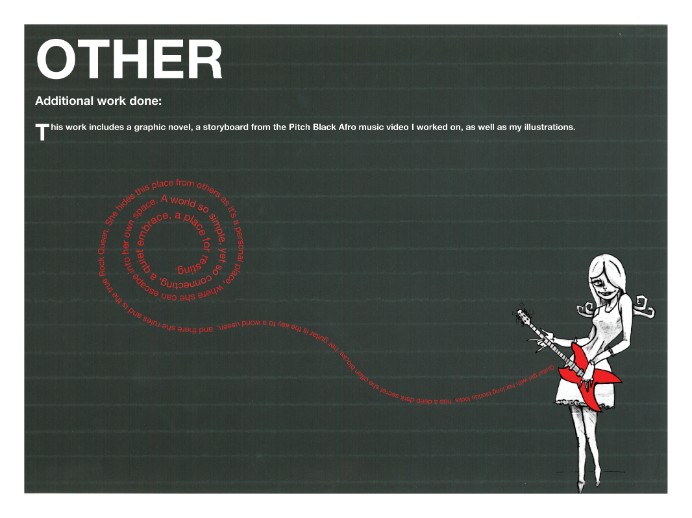

| Brief: For this task I decided to create illustrate a woman’s face. I did the illustration in ink. The swirls around the face emphasised the soft, Brief: |

Brief:

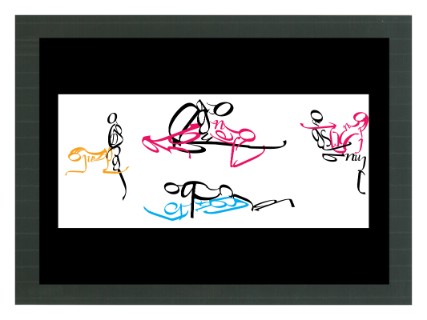

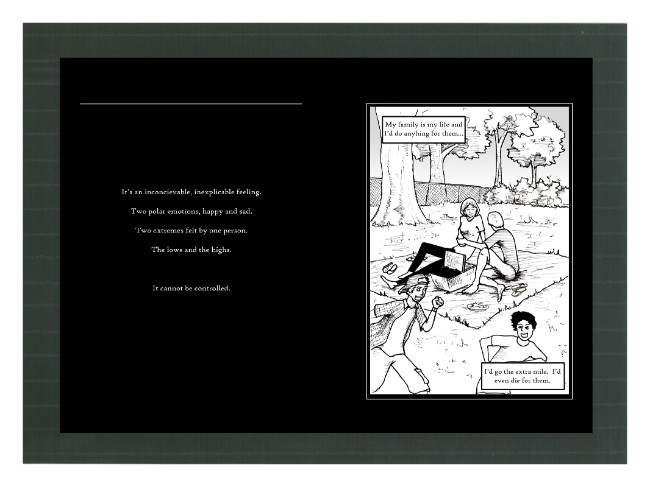

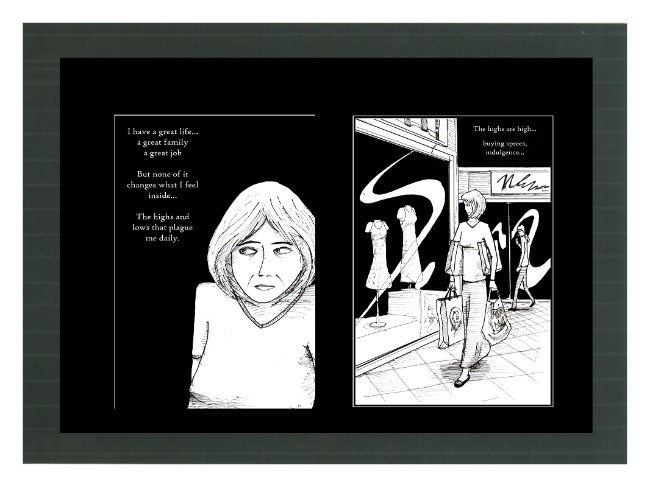

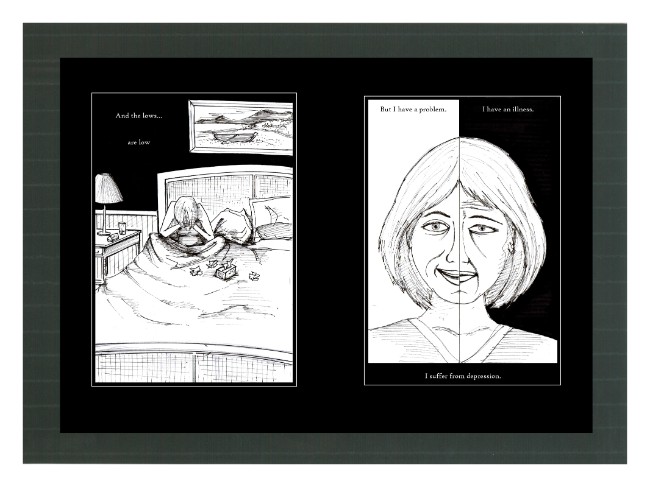

Create a graphic novel. For this assignment, I decided to create a graphic novel based on the subject of internal war certain individuals go through when suffering with depression and how people sacrifice themselves for the sake of their families.

Brief:

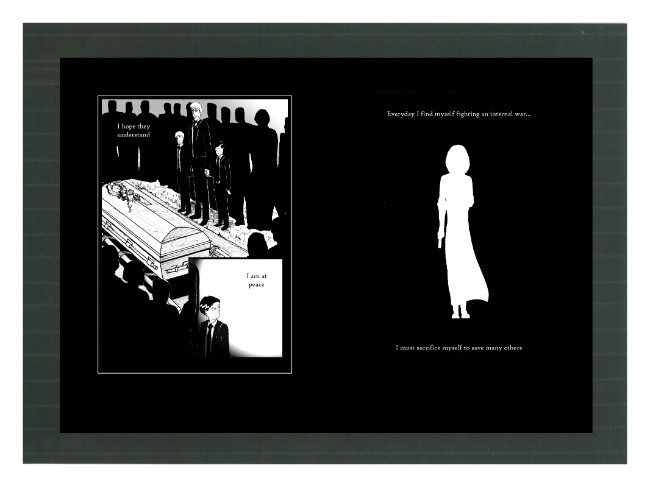

To create a music video for the South African music artist Pitch Black Afro. For this job I co-produced the music video for Pitch Black Afro’s new song, ‘Town to Town’. My job was to find dancers and locations for the shoot. In addition, I assisted the artist on the day of the shoot as well as organised food for the entire cast. I also art directed parts of the shoot, played AD and helped in writing up the shot list and treatment. The concept for the video for Pitch’s song ‘Town to Town’ was to show how Pitch is a king in his world, is constantly surround by women, and how he is the centre of attention.

Cast and Crew

Director - Adam Gordon

Producer - Adam Gordon

Co-producer - Bianca Belman-Adams

Art Director - Bianca Belman-Adams

DOP - Celia Scholtz

Makeup artist - Ciara Galvin

Stylist - Mpho Ntsimane

Runner - Chaka

Artist - Ptich Black Afro

Dancer male - Flip

Dancers female - Lindiwe, Emma, Priscilla, Pumla, Jade

This Corporate Identity design was created for our Brand Challenge group when working on the

|

letterhead

front and back of business card

STRATEGY

Ukhukhu Manje, endorsed by Rainbow Chickens - The brief was to create a bottom of the pyramid strategy for a new brand, it may be a sub-brand of an existing one. This brief was a collaboration with Dayne Shillaw, Tal Hassal, Shiri Berzack, Joshua Feigan and Kyle.

Contents

A. Our brand and category

Competitors

B. Business and Brand Value Chain

Supply Chain-(refer to Appendix 1)

C. Distribution and service as brand contact points

A brief overview of the internal logistics involved in the production cycle

Ukhukhu Manje’s Goal

A brief overview of what Spaza shops have to offer

The importance of a strong distribution strategy

Possible competitive advantage of our distribution strategy

Problems we may encounter and have to consider

Distribution strategies that we’ve considered for Rainbow Chicken Limited

D. Brand contact analysis for target market

E. Brand Start-Up and Contact Plan

Key Factors in the Current Economic Climate: (refer to Appendix 2)

Target Market Profile

Market Needs

Positioning

SWOT Analysis

Product Offering

Keys to Success

Critical Issues

Marketing Objectives

Financial Objectives

Marketing Strategies

Contact Plan

References:

Appendices:

Appendix 1 - Supply chain

Appendix 2 -Current economic climate

A. Our brand and category

Rainbow chicken is South Africa’s largest processor and marketer of chicken. The company breeds and rears its own livestock, which it feeds from its own feed mills. It processes, distributes and markets fresh, frozen, value-added and further processed chicken. Rainbow produces four million chickens per week and as such dominates the local chicken market.

Rainbow chicken competes in two market areas: Retail/ Wholesale stores (Rainbow and Farmer Brown) and Food Service (Food Solutions). The brand essence of Rainbow Chicken is ‘The heart of every meal’ and they strive to maintain high quality products, reliability in their products and a proudly South African outlook. The market in which Rainbow Chicken trades has a small amount of suppliers and Rainbow is the biggest. Together with its closest competitor, Astral Foods, they supply 60% of South Africa’s chicken supply. Country bird and Sovereign Foods both focuses on a lower income market while Rainbow Chicken’s targets a higher income market through their value added products, and their recent packaging design. This demonstrates smart foresight.

Rainbow competes aggressively with its competitors in terms of price in the fresh and quick frozen chicken portions category, and takes the lead in innovation in the less competitive premium and value added categories – so there is a relatively low level of competitive rivalry. With so much current credibility owing to the huge market share and already acquired loyalty to this product on behalf of the consumer, Ukhukhu Manje has the ability to broaden Rainbows brand architecture into other markets, offering a range of products to a larger, more eclectic market, in this case being those toward the bottom of the pyramid. Ukhukhu Manje is a packaged chicken solution for rural communities. The frozen chicken is packaged into small portions consisting of two to four pieces, with vegetables and extra ingredients in one box.

Competitors

Rainbow Chicken competes with products such as Country Fair and Early Bird, which belong to Astral Foods. Other competitive products include Goldi Chicken, Festive, Mieliekip and retail house brands.

Broiler production in South Africa totals an average of 14.6m a week. Rainbow Chicken produces 4.2m and Astral Foods 3.8m, Country Bird, a potential rising competitor produces a total of 1.2m broilers a week.

A potential competitor for the Ukhukhu Manje is Tekwane Farms Co Op Limited. These farms supply chickens to the rural markets around the Rustenburg area. They serve only hard chickens, which is preferred in the local communities. They are an established brand name within the surrounding areas and thus serve to be a competitor to Ukhukhu Manje They incorporate local labour on a volunteer basis, which drops prices of production. This price reduction could in turn affect the product that rainbow chicken is trying to sell. The local communities trust them more and thus breaking into the local market can be harder.

B. Business and Brand Value Chain

Rainbow is one the largest producer of chicken in South Africa with a large clientele consisting of KFC, Nandos and Steers. They are a fully integrated company from breeding the broilers to the distribution of the chickens. When examining their distribution, it is evident to see that Rainbow Chicken has two sides to their operation whereby value is added, one being in retail/wholesale with the other being food service. Rainbow Chicken Foods Pty Ltd is divided into 3 different sections: Rainbow, Farmer Brown and Food Solutions. Rainbow entails fresh and frozen chicken which then goes into simply chicken which relates to the value added product. Under Farmer Brown falls Premium Value Added and Fresh Chicken. Finally under Food Solutions, supplying the food and service industry falls under this section. This then goes into Ready 2 Go food. The market is segmented into fresh and frozen chicken, premium value added and fresh chicken and supplying the food service industry. This shows how the business is strategically structured to distribute their products to their appropriate target audiences. The value is also compounded with the Simply Chicken and Ready 2 Go range as value added products. Their products maintain a high quality with a service that is reliable when needed to its target market. This allows for value to be added through a strong relationship with their customers, quality and service. Rainbow Chicken is able to control the entire process from production to delivery, create and maintain

the correct amount of value that the brand requires for each segment.

Supply Chain-(refer to Appendix 1)

Rainbow places excellent service delivery in its integrated supply chain high on the agenda. During interviews with Rainbow buyers from Pick ‘n Pay and Checkers, both responded that Rainbow has room for improvement in terms of service delivery. Supplier criteria includes: Food safety, Pricing, Relationship and Service Delivery. Both agreed that Rainbow complies with the first three criteria points but is nowhere near to international standards on delivery, which is 95% delivery against consistency.

Although Rainbow sets high standards for its own suppliers, opportunity exists to be more transparent for example: who its Raw Feed Material Suppliers are, which are available in its Annual Report and has been rendered as confidential information by its Communications Manager. The quality and content of the company’s raw feed material, as well as whether it is locally or internationally produced, is an ethical consumer’s concern.

Brand and supply chain managers should be in frequent communication. Logistics have a direct impact on brand quality control, inconsistency and delayed deliveries can subtract from brand loyalty that has been build through expensive marketing campaigns. Retail is the gate to the consumer and the lack of excellence in service delivery and communication can have a detrimental impact on brand performance (Rainbow Chicken, 2009). Vector Logistics trucks are branded with a Vector Logo, as a subsidiary of Rainbow, a co-branding opportunity exists to brand some of the Vector trucks with the Rainbow logo. Ukhukhu Manje’s logo or even product offerings to entice relevant consumers with our unique selling propositions (Vector Logistics,2010).

Spaza shops serve as a vital brand contact point for the Ukhukhu Manje they offer a huge potential for contact points between the brand and the consumer. The first contact point is the actual product, which will be on display for potential customers to see. The second is the freezers that house the product. These freezers offer advertising space on the sides as well as the product itself inside the fridges. The delivery trucks that form part of the distribution strategy serve as a contact point because when delivering the food the rainbow chicken emblem is shown and thus another contact point or point of recognition is created between their product and the consumer.

C. Distribution and service as brand contact points

Rainbow Chicken Limited acts as a producer/wholesaler that supplies intermediary supply chains and distributors with the product in order to pass it on to the final consumer, they need to ensure that the brand itself and the supply chain managers are in frequent communication in order to regulate a successful distribution and service strategy. Rainbow Chicken Limited prides itself on managing successful and substantial relationships with all stakeholders involved in production process of their chicken. This allows them the ability to ensure the highest quality and consistency of their product before it hits the retail market. A brief overview of the internal logistics involved in the production cycle Rainbow Chicken Limited operates through four processing plants, five feed mills and 22 distribution facilities. Presently the company has 190 farms/hatcheries.

The company principally operates in South Africa with a workforce of 7,653 employees. The head office is located in Westville, Durban. Three processing plants are situated at Hammarsdale, KwaZulu-Natal, Worcester in the Western Cape and Rustenburg in the North-West Province. Broiler and breeder farms are strategically situated around each of the plants. Rainbow also operates a standalone further processing plant in Hammarsdale that has the capacity to produce freezer to fryer coated filleted and certain bone-in products.

As an integrated broiler producer, Rainbow Chicken focuses on the entire growing cycle, overseeing every step of the farming and production process. Rainbow Chicken’s control over the supply chain enables them to enforce health and safety standards such bio-security practices, humane treatment of birds and the assurance that all slaughter practices meets Halaal standards. Standards are maintained and improved through training and face-to-face interventions are possible.

The chicken products are then distributed via Vector Logistics (Pty) Ltd to the retail, wholesale and food service markets for reselling and consumption purposes.

In order for Ukhuhku Manje to become successfully amalgamated with the Rainbow name, Ukhukhu Manje has to thus involve itself with a strong presence in the supply chain and production cycle. Owing to the fact that this addition to the range that Rainbow offers is unique and has not been done by the company before, Ukhuhku Manje needs to ensure that processes involving this products development from hatchery to retail-store shelf have been included in Rainbow’s daily operations.

This includes quantity of chickens reared, packaging of the product in its unique boxes and final distribution of the product to relevant outlets. Ukhukhu Manje’s Goal Internally, Rainbow Chicken Limited has a thorough and successful process in developing a product of the utmost quality. Their problem now lies in continuing this positive consistency and delivery through our major contact point (that being the Spaza shops) which will act as a distributor of our product to the masses.

Seeing that Spaza shops will be the façade of their brand in terms of communicating a successful brand image, and in the long run ensuring positive associations with the brand, Ukhukhu Manje, would have to make sure that these Spaza shops embody our concept of a healthy brand. For example, if they choose to sell their product at informal stores on the side of the road, this may create unwanted or negative perceptions of their brand that are not in line with the quality and service delivery that is “Rainbow’s” core identity.

A brief overview of what Spaza shops have to offer:

• Because of the vast turnover handled by Spaza shops, they have become established members of the distribution channel in a short time.

• There are an estimated 750 000 hawkers, Spaza shops, shebeens and other informal traders across South Africa

who, cumulatively, are responsible for R30 billion a year of retail sales – an astonishing R17 billion of that on food alone (BMR study).

• 75% of informal market consumers use Spaza shops every day

• The average amount spent is R 175 per month

• Items most regularly purchased are milk, bread, and paraffin - but the complete range of products sell (from

fresh produce, to cigarettes, to newspapers, cool drinks and alcohol)

• 57% of the customers are women

• Spazas make up 10% of the South African retail spend The importance of a strong distribution strategy The pressure to meet consumer demand through effective supply chain management will bring marketing and logistics closer together. These types of vertical mergers become important because it allows farmers, processors and logistics to manage their production and delivery according to and in relation to market needs (Bhuyan,S. 2004).

Logistics have a direct impact on brand quality control and therefore the brand image, thus, inconsistency and delayed deliveries can subtract from the brand loyalty that has been built through expensive marketing campaigns. Brand recall, awareness, and perceptions on behalf of the consumer need to be managed through a service delivery system that operates at optimum performance all the time. This will ensure their consumers can rely on Rainbow Chicken Limited for consistent and constant product availability. Retail is the gate to the consumer and the lack of excellence in service delivery and communication can have a detrimental impact on brand performance.

As Rainbow Chicken is already equipped with distribution and logistics resources that are reliable and credible in their operations, and this coupled with the widespread market share of Rainbow Chicken around South Africa gives us the perfect platform to distribute their product to regions occupied by the target market.

Vector Logistics trucks are branded with a Vector Logo, as a subsidiary of Rainbow, a co-branding opportunity exists to brand some of the Vector trucks with the Rainbow logo. This can help generate awareness and act as a marketing tool during daily operations.

The possible growth and potential of this product to create and add value to the lives of many is visible in several distinct forms. Firstly, by supplying this product to spaza shops at discounted rates and allowing them to adapt the product to specific target markets, for specific occasions and according to consumer preferences, we give them the opportunity to involve themselves in the maintenance and success of Ukhukhu Manje’s operations as well as their own. For their valuable input, they achieve the ability to make returns on this product that otherwise would be impossible. As Ukhukhu Manje offers this product to these Spaza shop owners at discounted prices, they now have the ability to become a part of Rainbow’s treasured supply chain either as retailers or further distributors of this product based on the quantity of their purchases.

Spaza shop owners now have the incentive to further distribute this product to secondary retailers who feel that they have the potential to make a positive impact on Rainbow’s, Ukhukhu Manje’s as well as their own performance. A screening process will have to be implemented in order to ensure that those who are strategically geographically based and entrepreneurially inclined and who have the necessary personality traits in order to ensure that every contact the consumer has with Ukhukhu Manje will be a positive one will only distribute this product to consumers

By directly involving this array of retail and wholesale facets in Ukhukhu Manje’s brand architecture, we create a platform whereby local economies in these impoverished areas have the potential for sustainable and extendable growth both in financial terms as well as in skills building terms.

Our product will be sold in specially crafted and branded freezers which will act as a fantastic marketing tool as this product begins to spread across different regions as well as wholesale and retail platforms. Branded with both Rainbow’s logo as well as Ukhukhu Manje’s logo, these freezers now function as a constant generator of awareness to all those who enter the spaza shops. Possible competitive advantage of our distribution strategy Few Spaza shops have direct links with product manufacturers. Coca-Cola for example delivers directly to some Spaza shops that have to pay cash on delivery. Like SABMiller, they employ private security firms to accompany their delivery trucks. Smaller manufacturers cannot afford this and there are virtually no private distribution companies specialising in the townships. Spaza shops get no special discounts or services from wholesalers and the owners have to go by taxi or bus to purchase stock and bring the goods to their shops themselves.

Problems we may encounter and have to consider:

• Food supplied to sites, through national or international supply channels, determines foods available for

purchase.

• Food supply systems can involve a complex distribution chain involving wholesalers, intermediate purchasers,

distributors and vendors.

• On the one hand, this complex network creates jobs for urban dwellers, on the other, it increases the ultimate price paid by the consumer.

• The urban poor are particularly vulnerable to price changes due to limited income and cash reserves.

• Food availability may not be evenly distributed throughout cities.

• Wholesale food markets as well as discount supermarket chains are most commonly located in the city outskirts. These locations may not be accessible to the urban poor due to lack of own transportation, and inadequate municipal public transportation systems.

• The urban poor often are obliged to purchase food in small neighbourhood shops, which are more expensive than wholesale or supermarket outlets.

• In addition to being more expensive, there is limited availability of fresh meat and produce in these smaller shops (Food Security).

Distribution strategies that we’ve considered for Rainbow Chicken Limited

• Dedicated wholesale areas aimed at Spazas with product mixes most likely to sell

• Discounts that allow Spaza shops to offer loss-leaders or gain a higher margin to create a good marketing mix

• Phone-in order system - pre-packed for pickup or stock delivery directly to Spaza shops to save them time

• It should also be noted that by selling direct to the retailers Rainbow can reduce the need for their own retail and warehousing space, and also stock losses from a retail environment (Informal Traders).

D. Brand contact analysis for target market

In order to conduct a brand contact analysis for our brand we need to look at all the possible contact points. These contact points occur at any time when a possible consumer comes into contact with the brand be it in sight, sound or taste. In the brand contact analysis we will look at all the contact points from the point of production to distribution as well as advertising and marketing. All of the brand contact points need to be target market specific in order to reach the right consumers that they are trying to appeal to.

“Rainbow Chicken Limited operates through four processing plants, five feed mills and 22 distribution facilities. Presently the company has 190 hatcheries/ farms. The company operates in South Africa with a workforce of 7,653 employees.” These people who work for Rainbow Chicken, as well as anybody who comes into contact with the production factories or farms can be influenced by what they see. This is why the production stage of the chicken is first contact point. When people come in contact with the factories the brand is instilled in their minds in relation to the competitors in the market. The second contact point is the distribution channels that the brand goes through to the retailers. These include the transport needed to deliver the chicken. The trucks that transport the chicken are branded, as anybody who sees the trucks knows about the product and where it is going.

Once the product has arrived at its destination, the third brand contact point can be seen. This is the first time that consumers come into contact with our brand. The chicken is sold in supermarkets, hypermarkets, restaurants and convenience stores. This is an intrinsic step in the brand contact analysis as the look and taste of the product will certainly be the deciding factor for repeat buyers.

The brand’s values and positioning need to be integrated at this stage so that people know what the company is about and market the decision to purchase the product continuously.

An outside contact point that does not involve the actual product is the advertising and marketing done for Rainbow Chicken’s products. This creates an awareness of the brand and helps differentiate Rainbow Chicken from its competitors. The marketing and advertising helps to position the company ahead of its competitors and gain valuable awareness to potential customers. The advertising and marketing such as billboards, radio ads, commercials, handouts and promotions are all target market specific in order to reach the right consumers. Their contact points range from production through all the distribution channels and eventually the retail stores in which they are sold. There are however unplanned contact points that need to be looked at. These are external to the brand and are not controlled by the company. The main unplanned contact point is word of mouth. Through the right mix of marketing and quality produce Rainbow Chicken can influence both the planned and unplanned contact points to reach their target markets. The company needs to control all of these contact points in order to have a successful brand that consumers like and trust.

E. Brand Start-Up and Contact Plan

Key Factors in the Current Economic Climate: (refer to Appendix 2)

• Decreased Consumer Spending

• Global Increase in Soya and Maize Prices

• Decreased Advertising and Communications Budgets

• Imports

• High Per Capita Consumption

• Other Protein Prices

• Economic and Pricing Strategies

• Market Structure

Target Market Profile

• Live in rural areas.

• Irregular purchases.

• Live from hand to mouth.

• Low LSM, but enough to suffice - no storage.

• Purchase from Spaza shops or informal shops.

• Purchase of protein is a luxury item.

• Small protein intake.

• Individuals who purchase protein for them or their family.

• Provide for a few people, moneywise.

• Do not have too much cash for saving.

• Purchase chicken specifically for their needs - not for freezing, use immediately.

• Purchase pieces rather than whole.

Market Needs

• Packaging solution. A protein or a protein supplement.

• Purchase to use.

• Cheaper option.

• Simplistic purchase option, so all in one.

Positioning

The chicken brand that puts the consumer at the heart of whatever it does.

Product Offering

Packaging solution. The chicken will be packaged as pieces. The visual recipe changes with seasons. The ingredients packaged in the Spaza shops which is an incentive for the Spaza shops to sell their products. A branded freezer within the Spaza shops will be available to store the goods. A potential for further growth will get the secondary retailers will also get the freezers to sell the goods.

Keys to Success

• Logistics of the Spaza Shops.

• The Pyramid structure for further distribution, sustainability and economic growth of the sector.

• Packaging of the right products for the recipe.

Critical Issues

As a start up product, Ukhukhu Manje is still in its early stages. The critical issues for are for Ukhukhu Manje to:

• Establish itself as Ukhukhu Manje.

• Pursue controlled growth that dictates that payroll expenses will never exceed the revenue base, this will help to protect against recession.

• Constantly monitor customer satisfaction, insuring that the growth strategy will never compromise on service and satisfaction levels.

Marketing Objectives

• Maintain positive, strong growth each quarter.

• Achieve steady increase in market penetration.

• Decrease customer acquisition costs by 1,5% per quarter

Financial Objectives

• Increase profit margins by 1% per quarter through efficiency and economy of scale.

• Achieve a double to triple digit growth rate for the first three years.

Marketing Strategies

The intended product namely, Ukhukhu Manje, will be distributed via the Vector/ Rainbow Chicken co-branded trucks. The products will be taken to the Spaza shops where they will be sold to individuals from rural areas. Posters will be displayed that explain the price and product offering with regards to the changing recipes based on season. In addition, visual representations of the meals will be shown on the inside of the lid. The product will be placed in branded freezers to create further brand awareness. On condition that the product is successful amongst the rural communities, the secondary marketing strategy will be implemented. This also works within a pyramid structure, whereby the Ukhukhu Manje is bought from the Spaza shops at a discounted price and resold by individuals within the communities. There will be posters outside the seller’s homes with an explanation of the above. Based on their potential sales, freezers may be supplied. The main base of the marketing will come from word of mouth.

Contact Plan

• Co-branded delivery truck.

• Spaza shop.

• Posters- product explanation, price, visual representation of meal.

• Branded freezer.

• Packaging- chicken pieces together with vegetables and spices intended for recipe with a visual recipe on the inside of the lid.

Future Contact

• Secondary retailers who sell from home.

• Poster

• Potential branded fridge

• Packaging

SWOT Analysis

Strength

While Astral Food delivers on value for money products (Goldi and Festive), and value-added products (Country Fair Nuggets, Fingers etc.), Rainbow excels at understanding consumer needs. Rainbow addresses relevant consumer needs such as a health range under the Farmer Brown range. Rainbow also addresses the consumer trend for easy-to-cook, “oven ready” products with products like Farmer Brown pre-cooked chicken and Rainbow ‘Ready to Braai’ packs. Rainbow subscribes to the British Poultry Council’s Assured Chicken Production Programme. This council sets the highest standards for the nutrition and welfare of poultry.

A “gap” in the market for affordable meals for families living in rural areas has been pinpointed. Rainbow Chicken has the ability to assist in helping those individuals in the rural areas help themselves. The Ukhukhu Manje addresses consumer trends as quick, easy meals as it assists those individuals living in rural areas who ‘cook for the meal’ and do not store the food. The meals come prepared with recipes, vegetables, and spices appropriate for the meal. Rainbow Chickens Corporate Social Investment programs are focused on community involvement, mostly through educational support and feeding programs. Rainbow regards animal welfare as a high priority and actively complies with the SAPA Code of Practice (Southern African Poultry Association).

Weakness

Rainbow does well with in-store and television advertising, but there is a lot of opportunity for brand activation, that adds further value to consumer’s lives for example: cooking workshops, the sponsorship of food shows, online presence on women-interest and cooking websites. Besides for their co-branded trucks and in-store ads they do not have many print adverts.

While Rainbow monitors its brand equity within the Retail market, it is not as attentive within the Food Services market. Rainbow is a major supplier within the Food Services market, supplying businesses such as KFC, Chicken Licken, Steers etc. Whenever these brands are criticised, their supplier, Rainbow, is mentioned and as such, Rainbow’s brand equity suffers. Further monitoring and presence within this market is needed. As such, if the Ukhukhu Manje chicken sold from the Spaza shops would be off, this would possibly reflect on Rainbow Chicken.

Opportunity

Rainbow Chicken’s social and environmental practices are considered sound.

However, it may also be described as strategic fit, meaning that it has benchmarked itself against what is expected and has not explored the opportunities that are available through having clearer strategic intent.

There is a potential for biotechnology for Africa. Biotechnology could enhance the nutritional value of grains and fruits, promote the use of biofertilizers and help develop diagnostic tests and vaccines for livestock diseases and infections that risk food security.

With the dawn of the organic age, plenty of opportunity exists for free range offerings which can become an enterprise development project.

Threats

Ukhukhu Manje is a new product. If the pyramid structure for the distribution fails, there will be no sustainability

and growth for the Ukhukhu Manje product, the Spaza shops or the secondary retailers.

The price structuring from Spaza shops to other distributors.

The transport of products to other distributors.

Potentially too many middle men.

Specified Spaza shops need to be used based on their food produce and skill.

References:

Africa’s Biotech Future, 2009. [online] available from http://whatmatters.mckinseydigital.

com/biotechnology/africa-s-biotech-future

Bhuyan, S. 2004. Impact of Vertical Mergers on Industry Profitability: An Empirical

Evaluation. Review of industrial organization. Volume 20. Number 1. Pgs

61-79

BRM Study. Available online from: http://www.accessmylibrary.com/article-

1G1-11840745/spaza-shop-south-africa.html

CSIR, Imparial.2009. 5th State of logistics survey [online] Available form http://

www.imperiallogistics.co.za/

Food Security . Available online from: http://foodafrica.nri.org/urbanisation/

urbspapers/GinaKennedyFoodsecurity.pdf

Freshman, B.: 1999, _An Exploratory Analysis of Definitions and Application

of Spirituality in Workplace_,Journal of Organizational Change Management

12(4),318–327. in Pandey.A, Gupta, R.K, A Perspective of Collective Consciousness

of Business Organizations Journal of Business Ethics (2008) 80:889–898

Good Corporate Citizenship is a major factor in the purchasing decisions of

South Africans.

Informal Traders. Available online from: http://www.whythawk.com/emergingmarkets/

the-market-in-spaza-shops-and-informal-traders.html

Karnani,A. 2006.Mirage at the Bottom of the Pyramid. William Davidson Institute

Working Paper Number 835

Rainbow Chicken, 2009. Investors Presentation. [online] Available from: http://

www.rainbowchickens.co.za/investor_annual.aspx.

Sinclair, R .2010. Trends [online] Available from: http://www.bizcommunity.

com/Article/196/422/43608.html

Some Simple Steps and Strategies for SRI, 2007 Good Money, Inc. A version of

this can also be found in GOOD MONEY: A Guide to Profitable Social Investing

in the ‘90s by Ritchie P. Lowry (W. W. Norton & Company, 1991 and 1993).2010

[online] Available from: http://www.goodmoney.com/srihowto.htm

The Alliance for sustainability, 2009.[online] available from http://homepages.

mtn.org/iasa/tgmaxneef.html .

Vector Logistics, 2010. Services. [online] Available from: http://www.vectorlog.

com/Services.aspx?id=psd

Appendices:

Appendix 1 - Supply chain

Rainbow Chicken Limited operates through four processing plants, five feed mills and 22 distribution facilities. Presently the company has 190 farms/hatcheries. The company principally operates in South Africa with a workforce of 7,653 employees.

The head office is located in Westville, Durban. Three processing plants are situated at Hammarsdale, KwaZulu-Natal, Worcester in the Western Cape and Rustenburg in the North-West Province. Broiler and breeder farms are strategically situated around each of the plants. Rainbow also operates a standalone further processed plant in Hammarsdale that has the capacity to produce freezer to fryer coated filleted and certain bone-in products.

Each processing plant has fully-equipped accredited laboratories and trained staff to ensure that quality and food-safe chicken products leave the plants. Rainbow describes its operation as overseeing everything from the creation of the chicken on the farm to seeing that the chicken’s drumstick lands up on a consumer’s fork.

As an integrated broiler producer, Rainbow focuses on the entire growing cycle, overseeing every step of the farming and production process. Three generations of birds are produced in order to provide consistent highquality broiler meat. Birds are farmed at grandparent, parent (broiler-breeder) and broiler level. Rainbow’s grandparent farms regularly import pure genetic stock from Cobb UK. These pure-line, day-old chicks are reared under strict environmental controls on the pedigree farms in Carolina (Mpumalanga) and Nottingham Road (KZN).

Fully-grown birds are transferred to laying sites where for the next 10 months they produce eggs. Eggs are then collected and transported to the hatchery. At the broiler farms birds are grown purely for meat production by providing them with an energy and protein rich, highly nutritious diet. Each of the three generations of chickens is grain fed (Epol grain feed). As chickens are omnivores their feed contains a balance of grain and protein sources. It consists of about 70% maize and 30% protein, in the form of soybean meal and occasionally canola or animal protein. The broilers are then sent to the primary plants where they are humanely slaughtered in accordance with European Union (EU) Standards. Each plant operates two slaughter lines throughout the facility to handle fresh and frozen products for the market.

Rainbow’s control over the supply chain enables them to enforce health and safety standards such bio-security practices, humane treatment of birds and the assurance that all slaughter practices meets Halaal standards. Standards are maintained and improved through training and face-to-face interventions are possible.

The chicken products are then distributed via Vector Logistics (Pty) Ltd to the retail, wholesale and food service markets. Rainbow’s operation as an integrated chicken producer from “farm to fork” shows credible financial performance. The pressure to meet consumer demand through effective supply chain management brings marketing and logistics closer together. Rainbow’s strategy in the last decade to integrate their supply chain, led them to the purchase of Vector logistics. Vertical mergers become more important because it allows both farmers, processors and logistics to manage their production and delivery according to market needs. (Bhuyan, S. 2004)

Vertical mergers costs companies a lot, research by the CSIR and Imperial logistics shows that transport and inventory carrying costs are on an alarming upward trend, even when real increases are considered. Inventory carrying costs have doubled over the past four years and transport costs have increased by more than 50%.

Fuel, road quality, toll gates and skills development are the key cost drivers. (Imperial logistics, 2010) Though the integration of Vectors Logistics made sense in terms of efficient consumer response, effective risk management needs to be allocated towards logistics. Rainbow’s strategy to create brand insistence with the consumer means that sufficient budget allocation needs to go to marketing. Budgets allocated towards supply and demand, should not detract from value creation on either side (Rainbow Chicken, 2009).

Appendix 2 -Current economic climate

Decreased Consumer Spending

Throughout the world economically, 2008/9 has been a tumultuous period in the history of capital markets, with South Africa’s Consumer Price Index (CPI) peaking at 13,6%. Although it has fallen back to 8,5%;and prime lending rates have been lowered to provide respite for indebted consumers, the insecurity of a global economic recession has still kept consumer spending under pressure. Food and energy inflation has driven general inflation and, combined with higher interest rates, has placed pressure on consumers (Sinclair. R. 2010).

Global Increase in Soya and Maize Prices The global recession also saw the prices of feed raw material (soya and maize) peaking at historically high levels, and to date they remain exceptionally volatile (Rainbow Chicken, 2009).

Rainbow, and their competitors, sustained losses due to the rise of raw materials during the recession and this resulted in a strong rise in of feeding costs that affected their net profit. Decreased Advertising and Communications Budgets Advertising budgets are the first to go during a recession as companies focus on surviving rather than thriving.

Imports

Over the past few years, cheaper Brazilian and Argentinean chicken imports have flooded the South African market, stealing profit away from local producers. However, there has been a steady decline in imports in the last few years, largely due to the weakening of the rand, overseas suppliers diverting product into other more profitable markets and the effect of the significant capacity expansion locally.

High Per Capita Consumption

Domestic demand for chicken is growing in the region of 6% per annum, which outstrips the performance of other proteins on the market. Poultry forms 58% of South Africa’s animal protein consumption. This growth is supported by rising income levels that allow South African consumers to introduce more protein to their diets. This preference for chicken can also be attributed to health concerns about red meat, and the general medical consensus that chicken and fish are healthier protein options (Sinclair. R. 2010).

Other Protein Prices

While the health factor may hold may more weight for a higher LSM target market, the mass market are more likely to choose chicken due to the steady increase in price in red meat and pork over the last few year, as opposed to the lower price increase in chicken.

Economic and Pricing Strategies:

When reviewing pricing strategies, we should always consider the fact that the price elasticity of demand for chicken is more elastic for consumers. There are many substitutes for chicken such as beef, lamb, fish and pork. Price increases justified by value added products would therefore have a limited scope before consumers start to look at competitors and alternatives (Sinclair. R. 2010).

Another influence on chicken pricing, which resulted in an industry competitive advantage for all suppliers, was that the government exempted chicken in 2008 from value added tax (VAT). The reason for this is that the inflation rates and high raw material costs resulted in a rise in chicken prices. The majority of South Africa’s lower income market buys chicken, with LSM1 to 6 forming 70% of the South African population.

Price decreases result in a higher demand and therefore stimulate an increase for supply. A drop of 14% due to VAT in chicken prices may have influenced the growth that the chicken industry has seen in the last year, despite of the recession and the influence of inflation. Demand also increases due to crosselasticity, not only was the lower income market able to afford chicken, the demand for an alternative such as beef decreases in such a scenario. The price of beef has risen tremendously in the last three years.

Market Structure

In a micro economic environment, Rainbow Chicken trade in an oligopoly market, whereby a small amount of suppliers are responsible for the majority of chicken supply in South Africa. Rainbow is in a duopoly with Astral Foods (Early Bird Farms & Country Fair) and together they supply 60% of South Africa’s chicken supply. There are five significant smaller chicken producers amongst 50 even smaller suppliers, who together supply the other 40%. Even though an oligopoly exists it is not as homogeneous as the cell phone industry for instance, where three major players (Vodacom, MTN and Cell C) controls the market with little differentiation. Rainbow Chicken has created a differentiated oligopoly by moving from a commodity based supplier to a consumer-orientated supplier, and they are further building on this strategy through product innovation and range extensions (Rainbow Chicken, 2009)